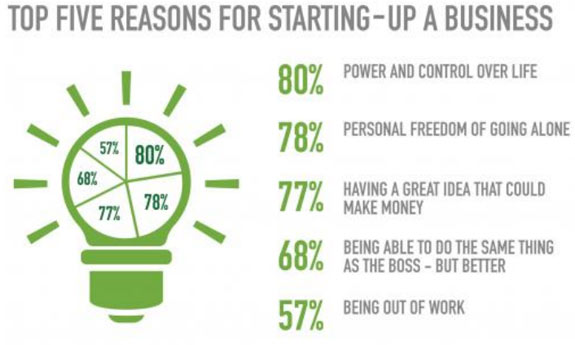

Maybe you’re tired of your current job. Perhaps you are bored of the 9 – 5 routine. Or you could just be yearning for the freedom and flexibility that comes with running your own business.

businesszone.co.uk/topic/business-trends

businesszone.co.uk/topic/business-trendsWhatever the reason, there's a tide of workers turning their backs on traditional employment and opting to set up their own business.

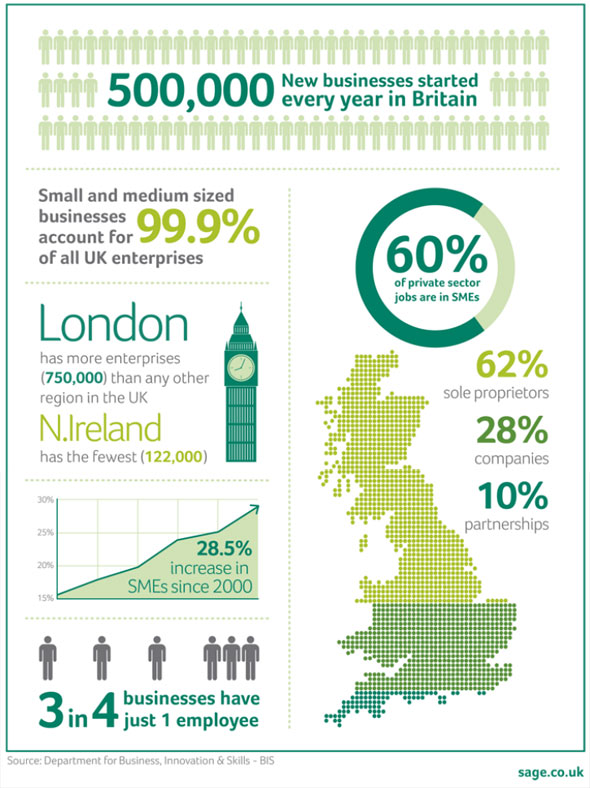

As many as 500,000 people opt to set up their own business in the UK every year, and that number is steadily climbing. In the last 13 years, the number of small and medium sized enterprises (SMEs) in Britain has rocketed by 29%.

Although the credit crunch and double dip recession has impacted on some economic ventures, the opposite effect has been seen on the number of new businesses being set up. With many individuals facing redundancy or unable to find suitable work, setting up a business has proven to be the solution.

Of course, wanting to set up your own company and actually putting the wheels in motion are two entirely different matters. If you're serious about making your venture a success, there's a long list of factors, which require consideration, attention and planning. Lots of planning.

We are going to take a closer look at some of the elements that need to be taken into account if you want your business to flourish. Every industry and sector will have slightly different needs but there are many aspects, which will be applicable to all. In our hypothetical example we will examine a business that provides products rather than services as the factors to consider are slightly wider.

Picking the right time to start up a business

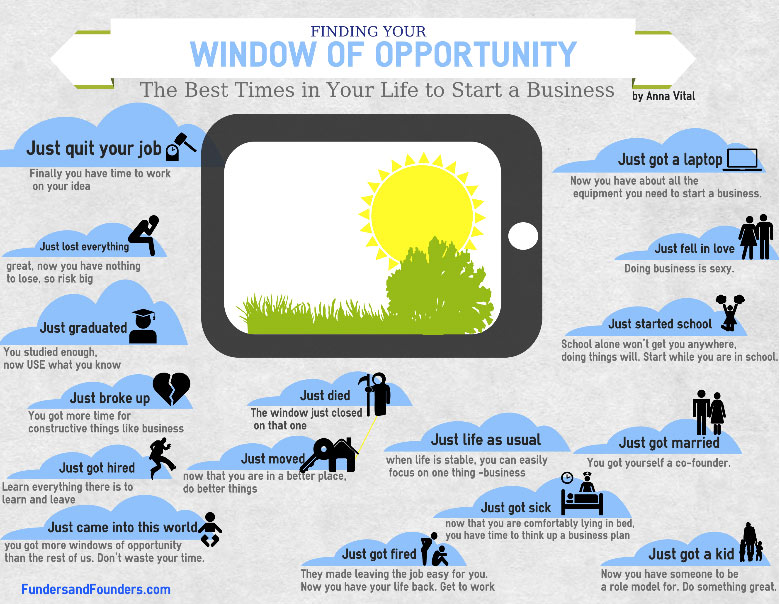

Despite your burning desire to be the next Sir Alan Sugar, it's worth taking a moment to think about whether you are picking the right time to make the leap into self-employment.

No matter how hard you think you work now, you can double or even treble that for when you are first starting out. No one said it would be easy, just rewarding. The initial months are undoubtedly the hardest when you may find you have to put in the most work for the least return. However, this will pay dividends in the long term and as all your plans fall into place, you will be able to relax slightly and make sure you've got your work/life balance right.

One of the biggest adjustments about setting up your own business is that at the end of the month, there's no guaranteed pay packet. Your income may be variable and to a greater or lesser extent, you will get out in monetary terms what you contribute in terms of effort.

This means you need to be able to dedicate time to focus on your fledgling firm and give it the TLC it needs to grow feathers and fly. You also need to be in a stable financial position so the urgency to earn cash doesn't dictate your business decisions.

For this reason, there are times in your life when starting up your business may not be ideal. For example, if you have just had a baby, or perhaps taken on a large mortgage, you may not be perfectly placed to quit your job. This doesn't mean you should give up on your dream but it may be more prudent to wait a few months, or longer, to make sure you are in the best possible shape before you set out.

….but there's no time like the present!

If you're wondering whether now is the right time to set up your own business, here is a fresh take on the different situations you may find yourself in:

www.entrepreneur.com/dbimages/blog/finding-your-window-of-opportunity-infographic.png

www.entrepreneur.com/dbimages/blog/finding-your-window-of-opportunity-infographic.pngCertainly there are times when setting up your business may be more challenging than others but if you really feel the urge to do it, then why wait?

It's important not to jump in without thinking it through carefully, but if you feel strongly that you just want to get on with setting up your business sooner rather than later, are prepared to juggle your commitments and understand what's needed, then get stuck in!

It's very easy to constantly find a reason to delay the move; like many things in life, if you wait for the perfect set of circumstances, you'll still be waiting when you're collecting your pension.

Ask yourself honestly: if not now, then when?

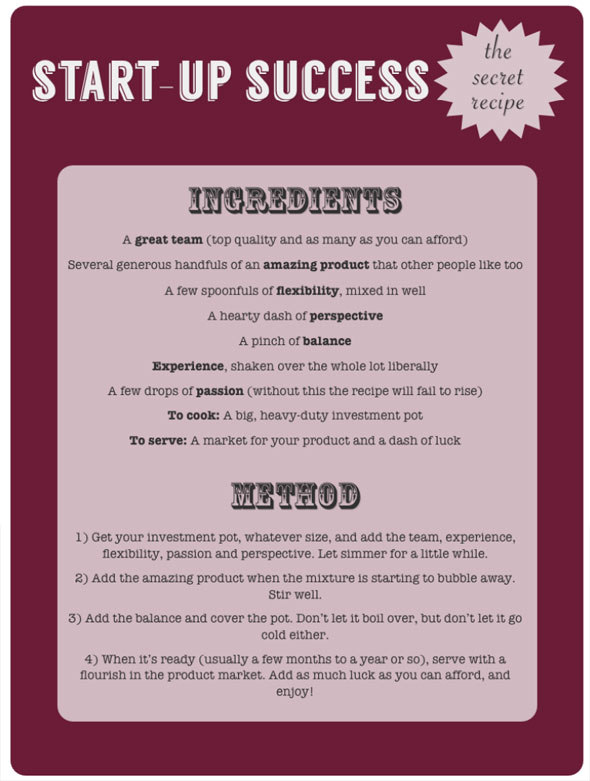

Compare the market

This phrase may conjure up visions of a Meerkat (in the UK), but checking out your competition and putting in tireless hours of research is one of the most vital parts of your preparation.

To be successful you need to know what's already on the market, how it's priced and how well it sells. There's no point putting together a business plan only to discover that your product is already being sold by a competitor for half the price and still doesn't sell well.

It's worth pointing out now that if you don't like putting in the legwork for researching the market, it may not bode well for your new venture. Checking out what's hot and what's not, and what your competition are up to will continue to be important to help you keep ahead of the game even after you are up and running.

Of course, you won't be in competition with everyone. Even within the same type of products, there will be a different target audience. For example budget brands versus high end quality, domestic versus business customers. Deciding whom you will be primarily aiming for will help to ensure you research is focused and meaningful.

From a more objective perspective you need to understand their unique selling point, the volumes they sell, market trends, their suppliers and where they source their customers from. Geographic location and main means of sales are also important; this could determine where and how you place your business.

It's also imperative to understand the key threats to the industry and where the dangers lie.

It may sound devious but you might want to consider purchasing something from one of your competitors. This will allow you to experience things exactly as a customer would and provide you with valuable insights into what they do and don't do well.

Canvassing family and friends for opinions and feedback may be a great starting point but it's not the best way to gain a solid market-wide understanding of customer perceptions. Consider using a specialist company to send out electronic surveys or even carry out small focus groups on your behalf so you can get good quality results; you might be surprised at how cheaply this can be done.

Skimp on research either in terms of time or effort and it's likely to show in the performance of your business.

www.smallbusinessheroes.co.uk/features/secret-recipe-start-success

www.smallbusinessheroes.co.uk/features/secret-recipe-start-successLocation, location, location

Once you understand more about your business, it's time to start putting some of your plans into action.

Determining who your customers will be and how you will distribute your products will be absolutely vital in determining where you set up your base.

If you are selling products you will need a warehouse to store them in and finding this kind of space in a city centre won't be cheap. If you can establish a delivery or mail-order business, you will find that you can economise on where you locate your premises. This could help protect your profits and keep your overheads low.

However, if you are planning on hiring staff, bear in mind that the location needs to be accessible, preferably with reasonable public transport links too.

But in your quest to find the perfect location thats offers value for money and ease of access, don't neglect the power of online selling. The online economy in the UK is worth a whopping £600 million per week, a market which is simply too large to ignore.

Even if you don't plan on selling online, having a visually appealing and up to date website could be well worth your time and effort. Research suggests that 80% of customers do their research online before going on to buy. 74% of customers who buy from a local firm check them out on the internet before making a purchase from them offline.

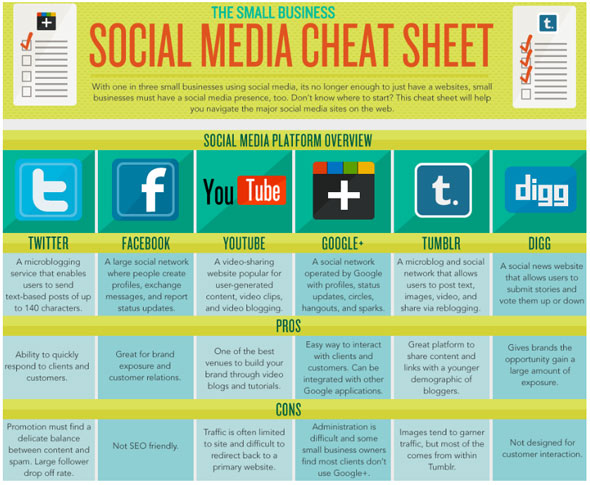

Don't neglect social media either; it may seem like a time drain but it's increasingly becoming the way to get your name known. If you're not familiar with the various different forms of social media, the guide below will help point you in the right direction:

www.thedrum.com/news/2012/01/25/infographic-small-business-social-media-cheat-sheet-0

www.thedrum.com/news/2012/01/25/infographic-small-business-social-media-cheat-sheet-0Business plan – moving on from the initial idea

Whilst your original idea may have been conceived on the back of a serviette or pub coaster, it's important to set out everything in writing, right down to the tiniest detail.

Having an in-depth business plan will not only help ensure you've thought of everything, it could ultimately also make it easier to secure funding too.

But the chances are you will never have drawn one up before, so what needs to be included?

The good news is that there is an almost limitless amount of free online resources to help you set up a business plan so there's plenty of help available if you need it. A good place to start looking is on the UK government website here.

Think of your business plan as an A-Z of your company; you will need an introduction, market analysis, marketing plan, operation and management plan, cash flow details and an executive summary.

Your financial backers, suppliers, employees and potentially even customers may see your business plan. It should therefore clearly set out exactly what the goals of the business are, any possible risks or dangers and how you plan on mitigating these plus how you will measure progress.

The statistics and facts you use to build your business plan need to be able to withstand interrogation. The Internet is a great source of information. Sites such as Cities Outlook can provide a good overview of an area's demographics whilst the Office for National Statistics provides a report, which includes information about the types of businesses and their success rates in the whole of the UK, broken down by region.

It's also important to keep your business plan as a live document; learn from your failures as much as your successes and tweak your plans accordingly. Ideally your business plan should be reviewed every six months as a minimum.

One final note: although it's great for a business plan to be upbeat, it needs to be realistic too. If your goals and aims appear to be based on fantasy rather than fact, you will quickly lose credibility. Make sure you forecast your short, medium and long term goals accurately and don't base your finances on unachievable targets.

To PLC or not to PLC, that is the question

Setting up a business may sound like a grand gesture but in reality, you may only have one or two employees. In the UK, three quarters of businesses have just one member of staff.

Setting up a business may sound like a grand gesture but in reality, you may only have one or two employees. In the UK, three quarters of businesses have just one member of staff.

SMEs are big business in the UK so even if you are only small, it's important to still approach matters thoroughly and in detail. These steps apply just as much to you as a new venture planning on employing tens of staff members!

As an SME, you have a number of different choices about the way in which you want to structure your business. Each has different advantages and consequences.

One of the quickest and simplest ways to set up is as a sole trader. Despite how this may sound, this does not mean you can't take on staff. Instead, it means that you are personally responsible for bills, debts and records and must pay Income Tax and National Insurance on the profits of the business.

A more detailed guide to what it means to be a sole trader can be found here.

Contrast this to one of the other most popular options: a limited company, which is a separate legal entity.

Unlike being a sole trader, a limited company needs to be registered with Companies House. There are also strict requirements about what accounts must be submitted and when. More information about your obligations can be found on the Companies House website.

A limited company also is taxed differently with the profits being subject to Corporation Tax, which is typically lower than Income Tax. Each company must appoint a legal director who can opt to receive their remuneration via a salary and dividends. This can be a more tax-efficient way of distributing profits.

However, being a director of a limited company also carries many responsibilities; more details about how a limited company works can be found here.

If you are setting up the business with another individual, you could instead opt for a business partnership. One of you must be officially nominated to complete the tax returns and also maintaining the company's records.

You will be required to submit both a personal self-assessment tax return and also a joint one on behalf of the business. Profits can be shared either equally or differently depending on how the business was created and you would normally be personally accountable for losses and bills incurred. More information about a business partnership can be found here.

One final word: you may have dreamt about being a PLC but this option is only available to publicly listed companies. A minimum share capital of £50,000 is required and in many cases, it may be traded on the stock exchange. But who knows, if your company is a success, you may become a PLC one day!

The painful part - funding

Every business will have its own requirements and some will demand a greater capital input than others to get going.

If this is the case, you have several options in order to set up your business.

Using savings may seem like the sensible option as it means you don't immediately rack up huge debts, but it could mean using up resources that you might later need if your business hits a lean patch. Using your home as collateral is an option but it's a high-risk approach.

A bank loan can give you the cash injection you need to get going and allows you to budget effectively. However, expect to face a grilling about the viability of your business and its potential returns. Banks are increasingly reluctant to provide finance to a company without a proven track record and you should expect to have to fund at least part of the capital requirements.

A very cost-effective option is to obtain a grant. These do not have to be repaid and are the best way of giving your blossoming business the helping hand it needs to get started. Grants are available in many different forms and it's worth checking out, regardless of the sector you plan on setting up in. Do bear in mind though that grant applications can be rather long and the money can take a while to trickle through. You will typically only qualify for around 15-50% of the costs; the rest of the money will need to be supplied by you.

A recent initiative is the Start-up Loans government scheme, which aims to provide £151 million in funding by 2015 to help new businesses get on their feet. So far more than 13,000 businesses have received funding with in excess of £66 million paid out. More details of the scheme can be found on their website.

If all else fails or you want to try a completely innovative approach, a more radical way to fund your business start-up could be through crowd funding. A means of finance that is rapidly gaining momentum, it's still considered very alternative but there have been reports of success. Links to crowd funding sites and a guide to what they offer can be found here.

If you feel a bit overwhelmed by all of the funding options, here's a quick comparison of the main choices available:

www.businesszone.co.uk/topic/finances/guide-small-business-funding-infographic/54202

www.businesszone.co.uk/topic/finances/guide-small-business-funding-infographic/54202You might also want to think about what you need the funding for. As an example, you may need lots of equipment or special tools but if they require lots of maintenance or are likely to become outdated quickly, it might be a better idea to hire them rather than buy. This not only allows you to stay up to date with market developments, you will also be free from maintenance costs and your initial funding requirements could drop significantly.

Getting cash flow and finances right are vital; 80% of the businesses that fail are because they get this vital element wrong.

Legal requirements

Before you start to equip your business, firstly consider what insurance you need to put in place.

If you have staff, Employer's Liability Insurance is compulsory and you could be fined an eye-watering £2500 per day you trade without it. All other types of insurance are voluntary but you may want to consider Product Liability Insurance, Public Liability Insurance and Goods in Transit insurance.

The Association of British Insurers have a comprehensive guide to all of the different types of cover you might want to think about which can be found here.

Health and safety is something that you must also take seriously, particularly if you plan on employing staff.

Exactly what this means might look different for each industry; for example, a warehouse will need different safety provisions than an office.

To use our hypothetical business, we will take a look at the kind of hazards you might find in a warehouse.

The main health risks come from manual handling, working at heights, and slips. Whilst there may always be a risk, it's possible to minimise the dangers by equipping your staff properly and providing the right kit - there is after all a good reason for there being over 60 different types of platform trucks and trolleys.

Safe storage can be achieved via the use of racking; don't plan on simply stacking boxes on top of one another. Not only will you not be able to make the most of the space available, it's also incredibly dangerous. Investing in cantilever or pallet racking will help you make the most of the space available and also protect your staff.

Pallets are another universal solution that can be used for all kinds of products. More modern plastic pallets are not only more durable, but they are stronger and less likely to split or splinter, protecting the hands of staff members.

Even small measures such as floor graphic markers or tape can help to identify hazardous areas or make walkways clearer, reducing the hazards in the warehouse.

Workers should be provided with work gloves, hard hats and high visibility clothing. You may also want to consider ear protectors, safety goggles and dust masks.

The Health and Safety Executive provides an excellent guide to the kind of equipment, which is vital to ensure staff are protected in the warehouse and it includes essential items such and mobile safety steps, access platforms and cable protectors.

All employers will need to have fire-fighting equipment freely accessible; this may include fire extinguishers, fire blankets, fire buckets or even emergency hammers. Fire and smoke alarms should be fitted as standard.

A basic Office First Aid Kit is another essential start-up item; you can purchase boxes which hold enough components to treat 10, 20 or 50 persons and comply with the Health and Safety Executive guidelines.

But it isn't just hazardous environments that are covered by Health and Safety; there are many other items which must be provided by an employer.

As an example, you need to provide toilet facilities, including hand basins with soap and either towels or a hand dryer.

You must also provide a place for clothes to be stored, such as metal lockers and you may need to invest in furniture suitable for a rest room, as employees must have a place to relax and eat their lunch away from their workstation.

Bins, sufficient workstation space, chairs and a clean environment are all also set out as mandatory in the Health and Safety Executive guidelines. Extras such as 'wet floor' signs for example may therefore be helpful to purchase.

You can find a more comprehensive guide to the Health and Safety Executive guidelines, which apply to all types of workplace here.

... and finally...

Author: Aaron Hawkins recently launched an online business and drew on his personal 'start-up' experience when writing this article.

Posted in Expert Commentary